I've been enjoying [cached]A Map that Reflects the Territory, a collection of the best LessWrong essays from 2018. While in general the essays are thought provoking and interesting, one set of essays gave me pause: [cached]Hyperbolic Growth and related chapters on fast vs slow takeoff.

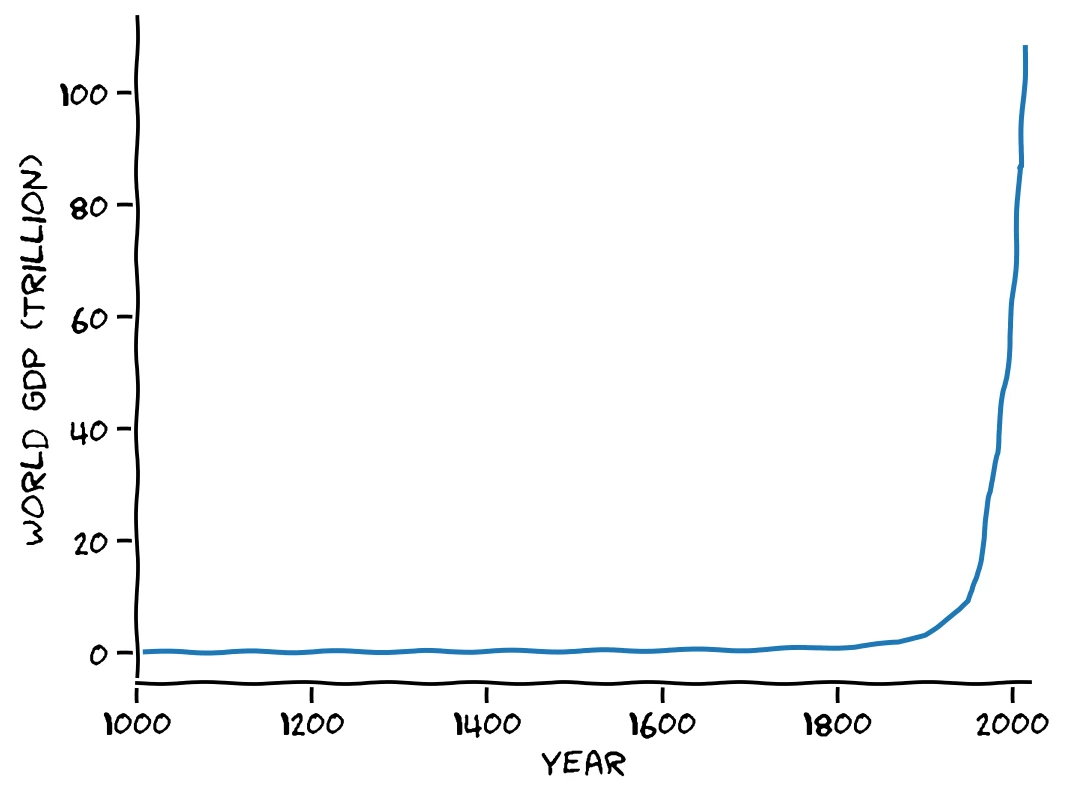

The discussion repeats tropes that are common in the rationalist and futurist community, describing how economic and technological [cached]growth have been accelerating and suggesting that they will soon increase so quickly that we will be unable to follow:

However, we have to be careful not to mix up …

(

(